You work hard your whole life to make a good life for your family. You might feel like you did it all on your own but in reality there is a reason why you are where you are today. Your family, your community and its institutions, the rule of law and in my personal opinion, most importantly, God, have prepared you and enabled you to live a fruitful life. Why not give back to help those out there that are not as fortunate? Why not make an impact on this world for good? Every life has a purpose. Perhaps your purpose is to really make a difference in the lives of others.

In an effort to encourage American taxpayers to provide resources for charitable organizations, Congress has enacted several tools in the Internal Revenue Code (“Code”). The government wants us to make a difference in this world and has provided some incentives to encourage you to enter into transactions that mutually benefit you and your favorite charity. There are certain limitations imposed by the Code and how they may be used, but there is also some latitude. Therefore, there is some flexibility to tailor a charitable vehicle (in philanthropic parlance this is called a “planned gift”) to fit your particular circumstances.

If you decide to change the world for good, it is important to engage an attorney who will work diligently to optimize the benefits for you. Though there will obviously be a benefit to the charity, you only want to enter into a transaction if you and your charity believe it meets both of your objectives and wishes. Though charities can be pushy and may encourage you in certain ways, you should never feel pressured into entering into a gift with which you are not comfortable.

It is not unusual for children to apply pressure on potential donors to not make planned gifts. The truth of the matter is that when a charitable component is incorporated into a wealthy family’s sophisticated estate plan (one that uses freezes achieved through Grantor Retained Annuity Trusts and Intentionally Defective Grantor Trusts, discounts achieved through Family Limited Partnerships and tax free liquidity obtained through Irrevocable Life Insurance Trusts), there is usually more money left for family than had the charitable component not been incorporated. Additionally, financial advisors are sometimes fearful that a planned gift means fewer assets under management – not true. The financial advisor can continue to invest the assets in a Charitable Remainder Unitrust and a Charitable Lead Trust. A Charitable Remainder Trust almost always leads to more diversification which means there are now more assets available for the financial advisor to invest.

In addition to all the financial and administrative benefits associated with establishing a planned gift, there is also the intangible reward of investing in a good cause and making a difference in the lives of others. Too many people today undervalue the importance of legacy and don’t spend enough time finding a worthy place for building that legacy. The funding and naming opportunities that speak to your personal interests and passions are limitless.

In Southern California the bulk of most people’s assets are in real estate. Unfortunately, due to the risks associated with managing and liquidating real estate, many if not most nonprofit organizations do not accept gifts of real estate. None the less, real estate makes the ideal asset with which to fund a planned giving vehicle. Sometimes even if the charity you want to benefit does not accept real estate gifts, a planned giving instrument can be set up without the charity’s involvement. Real estate can be monetized; capital gains liability can be avoided, as can estate tax liability; a large tax deduction generated; the set up and administrative costs can be minimal or even paid for by the charity and most importantly you can really impact your community in a positive way. To illustrate how all of these goals can be accomplished, three planned giving vehicles will be described in this article in detail: charitable remainder unitrusts, charitable lead trusts and charitable gift annuities for home. Although these names may sound like they describe overly complicated instruments, they are in reality very powerful financial and tax planning tools.

Charitable Remainder Unitrusts

A Charitable Remainder Trust should accomplish seven goals:

1.Increased annual pre-tax income.

2. An immediate charitable income tax deduction.

3.Avoidance of capital gains taxes.

4.Avoidance of potential estate taxes.

5.Relief from investment and/or real estate management responsibilities.

6.Protection of assets from future creditors.

7.Creation of a permanent legacy at your favorite charity.

While there are four types of Charitable Remainder Unitrusts, a FLIP Charitable Remainder Unitrust (“FLIP Trust”) is the most common planned giving vehicle for gifts funded with commercial real estate. This is because the FLIP Trust can be used to pass the rental income to the donors until the time of the sale of the property, which can be immediate or at some undetermined point in the future. When the sale of the property does occur, the FLIP Trust starts paying the donors a fixed percentage (the unitrust payout amount – which is chosen by the donor) of the trust’s principal based on its value as of January 1 each year.

Annual Pre Tax Income

A FLIP Trust will provide you with income annually for the duration of your life or up to eight beneficiaries’ lives. Your payout prior to the sale of the property will be limited to the lesser of the net income earned on the property that year or the stated payout rate applied to the value of the FLIP Trust. After the sale of the property, your payout will be measured solely by the stated rate multiplied by the net fair market value of the FLIP Trust valued at the end of each year.

The annual payout will be directly proportional to investment return, and thus, may be higher or lower in particular years.

Charitable Income Tax Deduction

By establishing a FLIP Trust you should also receive a charitable income tax deduction. As with all planned giving vehicles, the deduction is the present value of the remainder value of what is left to the charity when the gift vehicle terminates. A charitable deduction can be used to offset as much as 30% of your adjusted gross income (if you fund a gift with cash you can deduct up to 50% of your adjusted gross income). Any charitable deduction that cannot be used in the year of the gift can be carried over for up to five additional years for a total of six years. As such, the charitable deduction may dramatically increase your after-tax spendable income as the highest blended federal and California tax bracket is currently at 47.63%.

Avoidance of Capital Gains Taxes

By funding the FLIP Trust with appreciated real estate, you get the added benefit of avoiding capital gains tax on the sale of the asset. Blended California and federal capital gains taxes are currently as high as 37.1% (20% federal + 13.3% California + 3.8% Medicare tax). Avoiding capital gains taxes are the biggest reason why people use FLIP Trusts which is why they are sometimes referred to as “Capital Gains Bypass Trusts.” Since the FLIP Trust is a tax-exempt entity, when it sells the property, it pays no capital gains taxes. Thus, the entire value of the property can be put toward earning income. Likewise, the assets inside the FLIP Trust grow tax free but distributions are taxed under the four tier accounting system on the way out. By transferring your appreciated property to a FLIP Trust, you will avoid capital gains taxes that are triggered by the sale of the property and you will keep a larger portion of the proceeds working for you.

Avoidance of Potential Estate Taxes

Property placed into a FLIP Trust is not included in the taxpayer’s gross estate for transfer tax purposes. Although this property will ultimately pass to the charity and not to your heirs, there are ways for you to “replace” the assets being transferred to charity by using life insurance. By using an irrevocable life insurance trust as a “wealth replacement trust,” the cash value of the asset can be transferred to your heirs with no income, transfer or capital gains tax exposure. Additionally, an irrevocable life insurance trust can be designed to protect your heirs from the liability associated with property management or the dangers associated with leaving large assets to unprepared heirs.

Relief from Real Estate and Asset Management Responsibilities

If you desire to be hands-on with your real estate asset, you can be the trustee and/ or the property manager for your FLIP Trust. Some charities like universities or community foundations will be willing to serve as trustee and/or property manager and sometimes their services will be offered at highly discounted rates. Additionally, your attorney, CPA or a corporate or private fiduciary can serve as trustee and use a third party property manager. By choosing an independent trustee, you are divesting yourself of the management and investment responsibilities associated with your FLIP Trust. This is a great way to simplify your life. Whomever you choose as trustee needs to be a sophisticated professional that will ensure you get top dollar for your property and see that the proceeds are invested quickly and wisely.

For those families who are heavily invested in real estate and are looking towards retirement, a FLIP Trust provides a great opportunity to have some instant diversification because as soon as the real property sells, the proceeds are invested in a diversified portfolio of assets like stocks and bonds.

Alternatively, if you are not interested in diversification, the FLIP Trust can be used as 1031 alternative. Once the initial property is sold, the proceeds can be used to invest in new investment properties without abiding by the cumbersome 1031 exchange rules. For example, there is no need to quickly line up a replacement property like there is with a 1031 exchange. Unlike a 1031 exchange, you don’t have to worry about your basis because the FLIP Trust never pays capital gains taxes. However, it is important to note that the biggest drawback of FLIP Trusts is that the Code prohibits you from encumbering any of the FLIP Trust’s assets.

It is important to note that a FLIP Trust will not trigger a reassessment of your property for real property tax purposes.

Protection From Creditors

Property transferred to the FLIP Trust is protected from future creditors (this protection assumes there are no significant creditors with claims to the property at the time the property is transferred). Therefore, if you should get into creditor problems after establishing a FLIP Trust, the creditors will have a difficult time reaching the FLIP Trust property.

Legacy

While the tax and financial benefits are significant, perhaps the most important part of any planned giving vehicle is the lasting legacy that you will leave to the students of your alma mater, the patients at your hospital or the poor people your church feeds. What a wonderful legacy to leave to your children and community. The best way to teach your heirs are through the examples you set during your lifetime.

How the FLIP Trust Works

The FLIP Trust is a highly flexible vehicle. It allows you to transfer highly appreciated property without the recognition of capital gains, thus increasing the amount of funds available for future investment and growth. The FLIP Trust can be designed to adapt to a variety of personal financial goals. The charity ultimately receives the remaining trust property at the termination of the FLIP trust and it will then use such funds to support its mission. Everybody benefits from this relationship.

This is how a FLIP Trust works:

1.You would transfer your interest in the property to the trustee of your FLIP Trust. This transfer is irrevocable. The FLIP Trust will name you and your spouse as income beneficiaries for your lifetimes. Your favorite charity will be the remainder beneficiary.

2.The FLIP Trust will then begin paying to you the lesser of the net income from the FLIP Trust or the stated payout rate.

3.When you are ready, the trustee will sell the property to a third-party buyer. The proceeds from the sale will be allocated to the FLIP Trust.

4.Starting in the calendar year after the property is sold, the payout is no longer limited to net income and pays the fixed payout that you choose upon the trust’s creation. The payout amount is determined by valuing the trust assets at the beginning of each year and then multiplying the new value by your chosen payout amount. In other words, after the property is sold, the FLIP Trust pays you a variable annuity each year, not a fixed annuity. If the value of the trust property increases, the payment also increases. On the other hand, if the value of the property decreases, the payment decreases as well.

The FLIP Trust allows you to participate in the growth potential of the trust property, thereby increasing the income payable to you over your lifetime. It has been described as a “hedge” against inflation. However, there is also some risk that in a deflationary cycle, the revaluation could result in a decrease in the payments. If for any reason, you do not want to bear the risk of a deflationary cycle, there are charitable remainder annuity trusts that will pay you a “fixed” annuity.

The following flow chart shows the results from an actual FLIP Trust:

Charitable Lead Trust

A Charitable Lead Annuity Trust (“CLAT”) is the exact opposite of a FLIP Trust. Instead of paying you income during your lifetime, a CLAT pays a charity income over a fixed term and at the end of the CLAT’s term, the asset is transferred either back to you or to your children or grandchildren. There are two main types of CLATs:

Family Lead Trust

The goal of a family lead trust is to avoid transfer taxes. A family lead trust pays to charity the income produced by the underlying asset over a fixed term. At the end of the family lead trust’s term, the asset is transferred to your children or grandchildren outside of your taxable estate. Since the 40% estate tax only begins on estates with a value over $13,610,000 for a single person and $27,220,000 for a married couple (in 2024), these vehicles are for the wealthy who need to get their assets out of their taxable estate.

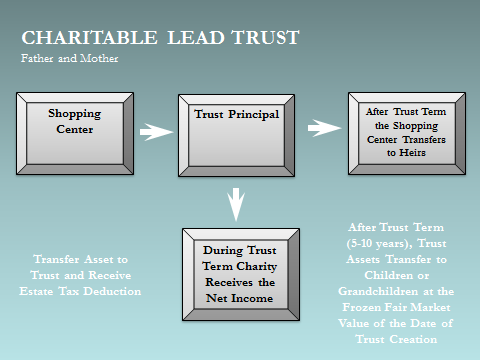

The following flow chart demonstrates how a Family Lead Trust works:

Grantor Retained Lead Trust

The goal of a grantor retained lead trust is to generate an upfront charitable income tax deduction. The CLAT pays a charity income over a fixed term and at the end of the CLAT’s term, the asset is transferred back to you the donor. This is a good vehicle for someone that is already making large annual gifts but then has a taxable event, like the sale of a real estate investment or a closely held business. The following outlines the advantages of a Grantor Retained CLAT:

1.An immediate charitable income tax deduction.

2.The return of the principal or the underlying trust asset at the end of the trust’s term.

3.Annual gift to charity during the trust’s term.

4.Relief from investment responsibilities.

Income Tax Deduction

For example, say a 6% Grantor Retained CLAT is funded with $500,000 for a fifteen year term. By establishing a CLAT you should receive a charitable deduction of $415,953. This charitable deduction can be used to offset as much as 50% of your adjusted gross income if the CLAT is funded with cash or 30% of your adjusted gross income if the CLAT is funded with real estate or securities. Therefore, the charitable deduction may dramatically increase your after-tax spendable income. If you increase the term of the CLAT or increase the payout rate, your charitable deduction will increase. If you shorten the CLAT term or decrease the payout rate, your charitable deduction will decrease.

Return of Principal

The amount of principal returned to you at the end of the term will depend on the investment return of the CLAT assets. During the CLAT term, your financial advisor will do his best to grow the value of the CLAT. A good conservative goal is an average 7% annual return. For the above example, if the CLAT is funded with $500,000, since the annual payout is fixed, if the CLAT earns less than the 6% annual payout amount, the CLAT principal returned to you will be less than $500,000. If the CLAT earns 6%, $500,000 will be returned to you at the end of the CLAT term and if the CLAT earns the projected 7%, approximately $625,645 will be returned to you.

Annual Gift to Charity

In our example above, a 6% CLAT will provide your chosen nonprofit with annual income of $30,000 for a term of fifteen years. You can choose the CLAT’s term and payout rate. The $30,000 amount is 6% of the original CLAT amount as of the date the CLAT is created. The payment is an annuity so the $30,000 is fixed for the fifteen year term. At the end of fifteen years, the remaining CLAT principal will be returned to you.

Relief from Investment and Real Estate Management Responsibilities

When you choose a trustee, you are vesting them with the fiduciary responsibilities associated with your CLAT. Like with the FLIP Trusts above, you can choose one trustee, one property manager, one investment manager and one accountant. Some large banks like Wells Fargo Advisors or universities like Pepperdine University might be willing to serve in these roles. Additionally, your attorney or CPA can also be helpful in filling some of these roles.

Legacy

The funds distributed from the CLAT can be used to create an endowed scholarship at your favorite college, send missionaries to Africa or build a new wing at your synagogue with your name on it.

How a CLAT Works

A qualifying grantor retained lead trust generally enables several years’ worth of deductions to be compressed into the current year. As the grantor, you transfer cash into a trust, which in turn purchases municipal bonds, stocks or other assets. The trust distributes a fixed amount of income to one or more charities for a term of years. After the selected term of years, the bonds, stocks and other investments are returned to you.

There is a specific reason for the use of municipal bonds within the CLAT. With a CLAT, income generated during the term of the CLAT is taxable. That includes any income paid to charities. When the trust corpus is invested in municipal bonds there is no taxable income during the trust term. This is because municipal bonds produce tax-free income; however, they typically do not produce high returns. Another option is to invest in a combination of municipal bonds and capital gain assets such as stocks. Investing in stocks should produce an overall higher return. Adding stocks to the portfolio will generate some long term capital gain that will be taxable to you. The long term capital gain is currently taxed at 23.8% (federal rate for high income earners) not including California’s 9% capital gains tax. While you may have some capital gain to report during the term of the CLAT, you will have taken an income tax deduction at your highest ordinary income tax rate in the first year of the trust. The upfront tax savings should more than offset any capital gains reportable during the first five or six years of the trust. Using a combination of capital gains stocks and municipal bonds should allow you to benefit from income tax savings plus a higher trust return during the term of the CLAT, resulting in more value to you at the end of the trust term.

This is how your CLAT would work:

1.You would transfer a real estate asset, securities or cash to the CLAT. This transfer is irrevocable. The CLAT will name your favorite charity as income beneficiary for a fixed term of years. You will be the remainder beneficiary.

2.The trustee will manage the real estate asset or invest the cash.

3.The CLAT will then begin paying to the charity the stated annual payout amount.

4.After the end of CLAT’s term, the CLAT assets are returned to you. By giving up income for a period of time, you are able to retain the principal and any gains while receiving a substantial income tax deduction in the year the CLAT is created.

Charitable Gift Annuity for Home

You have probably seen the commercials for reverse mortgages. Grandma has outlived her retirement and is hard up for cash. Although reverse mortgages have greatly improved in the last few years, what the commercials don’t highlight is what a rip off a reverse mortgages can be. The rates they pay are extremely low, there are closing costs and fees, there is usually a high end cap on the value of the home the banks are willing to write the reverse mortgage and it used to be that if you lived past your life expectancy, the banks would stop their payments.

A Charitable Gift Annuity for Home (“CGA for Home”) is like a reverse mortgage but generally pays much more and none of the other above mentioned reverse mortgage drawbacks apply. This is a very simple transaction to complete because, in essence, you simply retain the use of your home for your life and begin receiving a guaranteed annuity payment in return for deeding the remainder interest in your property to the charity. The only problem is not that many charities have these programs. After your lifetime, the charity receives your home and can use it for their benefit. The following highlights some of the advantages of a CGA for Home:

1.Continued control and use of home for life.

2.Annual income, much of which is tax free.

3.An immediate charitable income tax deduction.

4.Avoidance of potential gift and estate tax.

5.Protection of assets from future creditors.

6.Creation of a permanent legacy at your charity of choice.

Control and Use of Home for Life

A major benefit of a CGA for Home is that you retain control and use of the home for your lifetime or you and your spouse’s lifetimes. Remember, you retain a life estate, so for all practical purposes it is still your home. Under California state law, as a life tenant, you remain responsible for maintenance, insurance and taxes. Using a CGA for Home will not trigger a reassessment of your property for property tax purposes.

Annual Pre-Tax Income

By creating a CGA for Home you will receive an annual pre-tax payment payable in monthly installments, for the rest of your life or you and your spouse’s lives. This payment is fixed, it will never increase or decrease. This payment is also guaranteed by the full faith and credit of the charity, so pick one with a strong financial foundation.

Not only is the payment guaranteed, but a portion of the payment is income-tax-free, a portion is taxed as capital gain, and a portion is taxed as ordinary income. This calculation accounts for a $250,000 for a single persons or $500,000 for a married couple’s personal residence exclusion, which is why the tax-free payout portion is often so large. Thus, using a CGA for Home allows you to retain this important tax benefit. Furthermore, potential capital gains on the appreciation of the home are partially avoided because part of the gain is allocated to the gift component, and thus, there is no capital gains tax on that portion. The balance of the gain is allocated to the annuity amount and is taxed each year over your projected life expectancy.

Income Tax Deduction

By establishing a CGA for Home, you will also receive a charitable income tax deduction. This charitable deduction can be used to offset up to 30% of your adjusted gross income. Based on a 47.633% blended federal and California state income tax bracket for the highest earners, the charitable deduction can significantly increase your after-tax spendable income.

Avoidance of Gift and Estate Taxes

Using a CGA for Home causes the value of the home to be deductible from a taxpayer’s gross estate for transfer tax purposes, assuming you fall into the maximum 40% estate tax bracket. Although this property will not be passing to your heirs, because you will have given it to charity, there are ways for you to “replace” the assets being transferred to your charity by using life insurance as discussed above.

Protection From Creditors

Like with the FLIP Trust, in using a CGA for Home, the assets are protected from future creditors (assuming there are no significant creditors with claims to the property at the time the property is transferred). Therefore, if you should get into creditor problems after establishing a CGA for Home, the creditors will have a difficult time in getting to these assets.

Legacy

As stated above, perhaps the most important part of this plan is the lasting legacy that you will leave.

How a CGA for Home Works

Overview: The CGA for Home is a contract between you and the charity. You transfer a remainder interest in your home to the charity, retain the right to live in and use the home for your lifetime and the charity agrees to pay you a fixed annuity for your lifetime. The result is that you are generally able to substantially increase your income, obtain tax benefits and benefit society at large.

The payout rate is determined based on the age of the beneficiary at the time of the gift and the time the payments are to begin. The older the beneficiary, the higher the rate will be. When a CGA for Home is established to provide income for two beneficiaries, rather than one, the annuity rate is lower. This scenario occurs because the life expectancy of two individuals is actuarially longer than one.

The CGA for Home is also backed by the full faith and credit of the charity, not just the assets of the trust, as with other charitable vehicles.

What if you Want to Move? If you desire to change residences during your lifetime, it’s very simple. You and the charity just enter into a joint sale with the buyer. All of the net proceeds from the sale can then be used to purchase your new home. If your new home costs less than your old home, a portion of the “excess” can be (1) donated to your favorite charity which would generate an additional charitable deduction, (2) paid to you as an additional annuity for your lifetime or (3) paid to you as a lump-sum cash payment. If your new home costs more than your old home, you will need to pay the difference and you will receive an additional charitable deduction. There are several options available to you and many charities do not offer all of these options.

What if You No Longer Need or Want the Life Estate? If at some point in the future your circumstances are such that you no longer need a life estate in your home, there are a couple of things you could do. First, you could donate your life estate interest to the charity in exchange for an additional annuity that would be paid to you for your lifetime. Second, you could simply donate your life estate outright to the charity and receive an immediate charitable income tax deduction. Third, you could rent out your home to a tenant to receive an income stream in addition to your annuity payment.

The following flow chart highlights a real life example of an actual CGA for Home:

The information in this article is intended to be a general description of tax laws and is not advice as to any transactions, nor is this article advice to any person or to any client and should not be relied upon as such. If you or your client desire to receive specific legal or tax advice on a specific transaction, then please call Caldwell Law at (818) 651-6246.