Blog

Welfare Exemptions

In California it is possible to receive 100% real property tax abatement for certain non-profit and nonprofit/ for profit hybrid uses. The California Legislature has the authority to exempt property that is used exclusively for religious, hospital or charitable purposes …

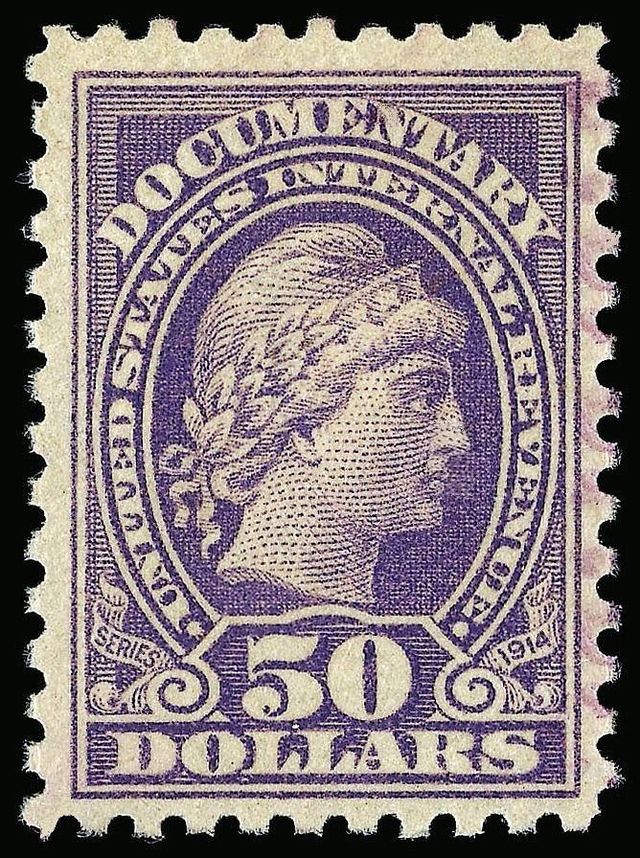

Documentary Transfer Tax Exemptions and the ULA Mansion Tax

All counties in California impose a documentary transfer tax of 55¢ per $500 of the fair market value of the transferred real property. The City of Los Angeles imposes an additional $4.50 per $1,000 of the fair market value of …

Avoiding California Real Property Tax Reassessment

Proposition 13 In 1978 the citizens of the State of California voted in an initiative to limit property taxation which is now embodied in Article 13A of the California Constitution (“Prop 13”). After the law was passed …

Do I Need A Living Trust?

If you have children, own your own home or have assets worth more than $184,500, you need a living trust. If you do not have a living trust properly executed and funded as part of a basic estate plan, upon …